What is a Routing Number? Its Function, Use, and How to Find It

What is a Routing Number and What is it Used For?

A routing number is a unique identifier assigned to each bank or credit union in the United States. It consists of 9 digits and allows transactions between financial institutions to be directed correctly.

A routing number is managed by the American Bankers Association (ABA) and is also known by other names, such as transit number, ABA routing number, or RTNs.

Why do you need this routing number?

If you work as a freelancer and have an account in the USA, it serves to perform multiple financial operations:

Opening new bank accounts or setting up online banking services.

Receiving payments from U.S. clients or sending via ACH or Wire systems.

Issuing checks.

Setting up direct deposits so that payments to your account are prompt.

Paying your bills and automated services with your account.

The routing number is essential for the financial institution to know exactly where the funds will be sent or withdrawn.

How Does a Bank’s Routing Number Function?

When you initiate a bank transfer, the routing number identifies and verifies the issuing and receiving institution.

Moreover, each bank routing number is unique, making it a secure way to carry out transactions between banks.

For example, if you are going to receive a payment, you must give the sender your routing number so that the funds reach your bank account. Just make sure to provide the exact details so that the transaction proceeds quickly and without errors.

When is it Essential to Know Your Account’s Routing Number?

There are several situations where you will need to know your routing number, such as:

If your clients deposit money directly into your U.S. bank account.

When you need to send or receive wire transfers, either national or international.

If you set up automatic payments for services and bills.

In case you need to receive tax refunds in your bank account.

To move money between different accounts.

If you want to adjust direct deposits, payroll payments, or other recurring payments via ACH transfers.

If you are going to issue digital checks.

You will also need it if you decide to use DolarApp to receive fund transfers to your account, as well as for making shipments.

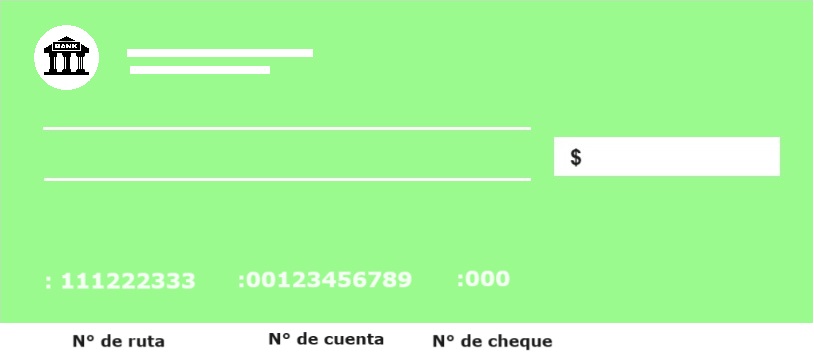

Where to Find the Routing Number on a Check?

You can locate the bank routing number at the bottom left of your checks, whether personal or business.

Here is an image:

3 Ways to Find the Routing Number if You Don’t Have a Check on Hand

If you do not have a printed check on hand to view your routing number, don’t worry, there are other 3 ways to get it:

3. From the app or online banking. Logging into your account through online banking or using the bank’s app is the most common way. Generally, it is displayed when selecting the corresponding account.

2. Checking your bank statement. Some entities include the routing number on the monthly bank statements. This usually appears in the upper right corner.

3. Via ABA. You can also find the routing number through the ABA Routing Number Lookup tool.

For this last option, keep in mind that you must first accept the service conditions to use it. Moreover, its use is limited to twice a day or ten times a month.

Difference Between Routing Number, IBAN Codes, and BIC/SWIFT

The routing number, IBAN codes, and BIC/SWIFT serve to identify both banks and bank accounts, but they are used in different contexts and regions.

The routing number is used only in banks within the United States. Its function is to identify the financial institution in national transactions, such as ACH or Wire transfers.

Its format consists of 9 digits.

While the BIC (Bank Identifier Code) / SWIFT is used for international operations. Therefore, its function is to identify banks in international transactions.

It consists of 8 to 11 alphanumeric characters.

The IBAN (International Bank Account Number) is also used in international transactions but focuses on European countries. Its function is to facilitate cross-border transfers by identifying international bank accounts.

It consists of up to 34 alphanumeric characters, depending on the country.

Conclusion

Knowing what a routing number is and how it functions facilitates transfers and ensures that funds reach their destination without issues. This is ideal for any freelancer who works in U.S. territory or has a bank account in the country.

Although, you can transfer or receive money to other countries using IBAN or BIC/SWIFT codes.

And with DolarApp, you can obtain a U.S. account to manage pesos or dollars. So you can take advantage of it to send remittances to your country or as a payment method for your clients.

Your Money

Your Money

Your Money

Your Money

Your Money

Your Money

Your Money

Your Money